Many people see investing as a tool for the rich. In some ordinary circles, people talk about “putting a wage on the stock market,” but it is a serious matter—at least investing directly with no leverage.

Why Investing Matters

- Risk Management: identifying, assessing, and managing win and loss trades to ensure long-term profitability.

- Market Psychology: understanding emotional biases.

- Investment strategies: an approach that works for you efficiently.

- Long-Term Growth: building wealth over time.

How I got into investing

In our early twenties, despite having jobs, money was always tight. So, we turned to the one tool we saw as a game-changer: the Internet.

The Early Internet Era in Romania

In Romania, the Internet was still in its infancy. Few understood its full potential, as access to financial knowledge was limited, and online trading was almost unheard of.

Internet cafés were uncommon, and few people had internet access at home. Dial-up connections were slow and expensive, but many young people—around 60%—were using them to chat despite these limitations.

The rest enjoyed PC games, and a smaller group used platforms like mIRC for messaging.

I discovered online trading communities

Back then, people used Romania’s Internet to chat and play games. A small group, however, discussed finance and trading on platforms like mIRC and Yahoo Finance chatrooms.

Even though mIRC was a gateway to various online communities, only a few used it to discuss business and investing. Later, we discovered those focused on trading and investment strategies.

Curious about these discussions, I began exploring chat rooms where traders shared insights.

I first encountered terms like Forex, technical indicators, and leverage. This technical, social environment set the basis for my trading journey and, later, investing.

Lessons from My First Trades

The Risks of High Leverage

My friend took more risks while trading. He had always been trapped in the illusion that markets offer free money.

However, after a significant loss, he stopped trading altogether. He had been under the illusion that constant risk-taking was the norm, but it was more akin to gambling. He hoped for a big win but realized this strategy wasn’t working the hard way.

We were both rookies and didn’t understand how to handle the leverage we were using.

The consequences of his high-risk approach became apparent quickly—sleepless nights, tardiness, and errors at work. After this turbulent period, he disappeared.

In contrast to him, I approached the market with more caution.

While I had some risk appetite, improving the odds was essential.

The market felt inefficient, but I couldn’t quite identify where its flaws were at the time. While encountering setbacks, I learned through trial and error, but I’ve kept pushing forward.

My Obsession with Learning

For years, I was fascinated by the Wall Street professionals I saw on TV—dressed in black suits and rushing to their offices. Their seriousness while talking to clients and in meetings made me pursue a similar career.

I went to finance school but gave up because stock markets were accessible only in the third year.

Education vs. Passion

I considered attending an economics school, but my father, who had studied a technical field, wanted me to follow a similar path, which I declined. I would stick to my dream of investing, no matter how much time, effort, and dedication it would take. I was determined to make it happen.

Reading Everything I Could

I spent my free time reading various books, including fiction, technical guides, management, marketing, and self-improvement.

I didn’t care what it was about as long as I was learning about financial markets. I often read at a mobile repair shop where I worked, or I’d run home just a block away to check the latest on the Forex market, especially during interest rate decisions.

At the time, my boss was furious that I checked the markets while on the job, but I was more interested in Forex than in selling mobile phones.

My First Trading Success

I developed a Martingale strategy, using high leverage, and made a few months’ worth of salary in profit. I was finally able to take the long-awaited trip to the Black Sea.

The Martingale system is a betting strategy in which you double the initial stake after every loss, hoping to recover losses in one big win.

While some traders use it in markets, the Martingale system is unsuitable for low-risk investors.

How it worked?

I used the GMACD indicator, which is more like a flashy indicator that gives a two-color interpretation of what the moving averages and histogram of Moving Average Convergence Divergence (MACD) do on multiple time frames.

For example, when the lower time frames indicated downside market corrections, I would have bought the asset until it was realigned with a higher time frame signal.

I eventually realized that the indicators I relied on were less helpful than I thought.

At the bottom of this article are several articles about investing, some of which are investing ideas I've tested, from basic to more advanced technical analysis methods and strategies.

You'll find explanations behind the closed trades I made.

Reframing Elliott Wave Theory

That’s when I discovered the Elliott Wave Theory, a method that provided a way to predict market movements based on repetitive, mathematically quantifiable patterns in the form of waves.

Market participants would create a structural pattern, and investor sentiment would reflect the change when it occurred.

I spent much time researching trading strategies that could incorporate the dynamic state of markets.

A YouTuber who offered a fresh perspective on the Elliott Wave Theory caught my attention. Though I can’t fully vouch for him, his approach to motive waves was revolutionary.

By improving my observation skills, I could pinpoint market behaviors more accurately. While I still make mistakes, they are far less frequent than before.

Creating My YouTube Channel: Morraevo

After attending a free financial seminar, I started my own YouTube channel.

The speaker at the workshop spewed nonsense and promoted FOMO by saying things like, “If you invested back then, you would’ve made X profit.“

Despite my frustration, I stayed until the end and decided to take matters into my own hands by offering real value to others.

I began creating video analyses of currency pairs (Forex), commodities, funds, and crypto, aiming to help newcomers understand the complexities of investing.

Many financial YouTubers copy content from viral videos, recommending popular stocks like Tesla or Palantir. However, actual investors focus on more than just meme stocks.

They have been inspired by Cathie Wood’s ARK Invest fund, which focuses on tech companies and has gained significant attention since 2020, when ARK’s performance was impressive. But it’s crucial to remember that substantial funds can protect their losses in ways individual investors can’t.

It’s easy to get caught up in popular stocks, but diversification is key. Expecting the same results from one sector year after year is unrealistic.

Investing, like businesses, requires constant adaptation. One rule of success is to change more often. So, I’ve had to refine my approach by integrating technical analysis and fundamental factors, hoping to beat the market over time.

My Current Investment Portfolio

I invest primarily in Romanian markets, but I’m preparing to expand to more liquid, global markets.

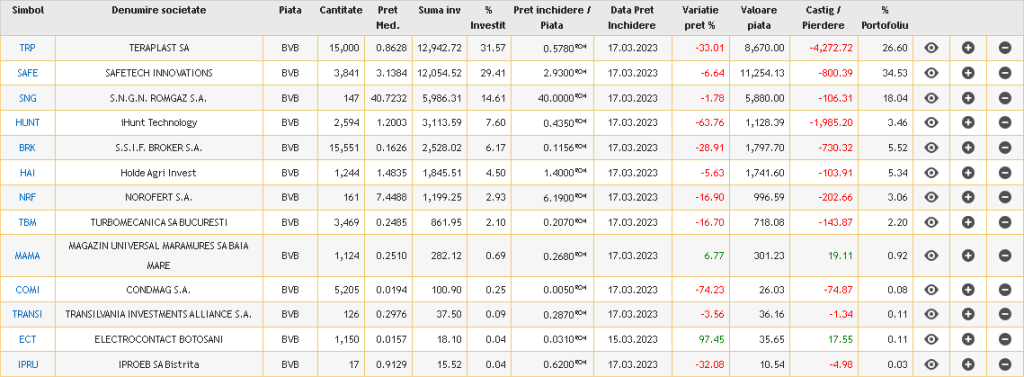

After heavy losses—mainly in two stocks (Teraplast and iHunt Technology)—I’ve invested approximately $8,800.

My portfolio is now 21% lower, but I remain focused on learning and growing my investments.

Investing articles

- Breakdown on Banca Transilvania (TLV technical analysis)

- Will Bitcoin Hit 100.000 To Fulfill “Mainstream Prophecy”?

- Capital Market Analysis As Of 1st May 2024: Fund Rates And Latest Data Analysis

- Stock Portfolio Disappointment: I’ve Sold My Share In Teraplast

- Are Romanian Energy Stocks In A Hype? – Hidroelectrica, CONPET & Rompetrol Rafinare

- Is The Romanian Energy Sector Stocks A Strong Hold? – Transelectrica & Rompetrol Well Services

Disclaimer:

Investing in markets carries many risks regardless of the market and the use of leverage, which is unsuitable for anybody.

This article is not for investing purposes but only for informational purposes.