Fondul Proprietatea Overview

Contrary to the mainstream opinions of investors, who hope for exceptional returns for some Romanian stocks and implicitly for the BET index, I have a negative view of many Romanian stocks after the recent growth.

This dynamic ended during the earnings publication on 29 February 2022. The development has led to an overvaluation of many stocks, but the S.P. E. E. H. Hidroelectrica IPO, which insiders probably speculated about, should have been noticed by mainstream investors.

Significant changes in the wave structures occurred, specifically when the price reached 1.694, and I had to exit Fondul Proprietatea soon afterward. These changes, which were the internal Running B-wave, a larger structure in the making, indicating a shift in the stock’s trend, prompted me to sell.

Who I am and what I bring to the table?

My name is Andrei; I have been an experienced investor in the Romanian capital market since 2007. I share my insights and experiences with you. I’ll present a chart analysis based on the refined Elliott wave theory, a strategy I’ve successfully used to justify a key exit from my portfolio.

My investment on Fondul Proprietatea

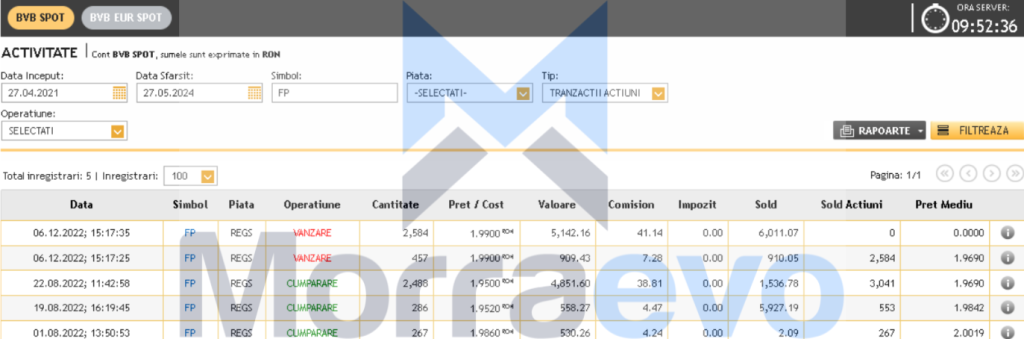

I bought Fondul Proprietatea when the price was around 1.986, 1.952, and 1.95, respectively, anticipating it would fall around 1.95.

However, when the price fell below the expected price, dipping below the 1.72 level, I took a step back. I reviewed the entire structure and made the necessary adjustments to my portfolio, ensuring I made the most informed decision.

Fondul Proprietatea Technical Chart Analysis

Now that we have more information about the behavior of active investors on Fondul Proprietatea who have built repetitive patterns on the chart, we have the following:

The price is now at the end of wave C, in green, part of a FLAT.

The pattern has reached the minimum required level, so be careful with this action; from now on, the stock can collapse below 1.72 to complete the C wave of the upper degree ABC – a FLAT, colored in yellow.

If you liked this you might also like: Will The Latest News Affect AstraZeneca Stock Price?

Disclaimer

This article isn’t trading advice, and any financial loss associated with it is solely your responsibility.

However, a more cautious investment approach can generate stability and profit in the long run.

Refined Elliott Wave patterns are hard to identify, and there is always room for error, and I don’t recommend using them especially if you are a begginner in investing. Always seek professional financial advice when investing. Thank you!