AstraZeneca PLC announced that its jab against the COVID-19 vaccine produces blood cloths.’

As of 25 April 2024, the company had 182 current projects in development.

Its stock price has risen regardless of the scandal.

Will AstraZeneca continue to grow and keep its stock moving upward despite the lawsuits?

AstraZeneca PLC presentation

This corporation is one of the largest pharmaceutical companies.

It has a capitalization of nearly 190 billion dollars.

It focuses on the whole chain from discovery to producing and selling drugs.

The company researches respiratory, cardiovascular, renal, gastroenterology, metabolism, neurology, and immunology.

The company is focused on cancer and rare diseases like lupus as well.

One of the most commonly heard cures is Lynparza, used to treat some forms of cancer like ovarian, breast, pancreatic, and prostate in some patients.

Competitors of AstraZeneca (LSE: AZN)

The other big pharma companies are GSK, Pfizer, Johnson & Johnson, Sanofi S.A., Merck & Co., Novartis, Roche Holding AG, AbbVie Inc., Amgen Inc., Bayer, Biogen Inc., and Bristol-Myers Squibb Co.

The biopharmaceutical industry is a big business, totaling 3-4 trillion dollars.

This sum is If we were to rank all the biopharmaceuticals on capitalization, we would start with Johnson & Johnson (400-500 billion dollars), followed by Roche Holding AG (250-300 billion), Merck & Co. (260-280 billion), Novartis AG (200-250 billion), and Pfizer (200 billion).

The rest of the companies have capitalizations below AstraZeneca: Sanofi S.A. (160-180 billion), Amgen Inc. and Bristol-Myers Squibb Co. (both 120-140 billion), GSK PLC. (60-80 billion), Moderna (40-50 billion), Bayer AG (45-50 billion), and Biogen Inc. (40-55 billion).

Pharma industry share

However, the industry is not uniform.

For instance, the vaccine industry is a pie shared between Pfizer, GSK, Merck, and Sanofi.

The company was rebranded as AstraZeneca PLC in 1999 (former Zeneca Group PLC).

However, the industry is not uniform. There are eight sub-sectors as follows.

For instance, the vaccine industry is a pie shared between Pfizer, Novartis, GSK, Merck, and Sanofi.

The cardiovascular sub-sector brings Pfizer, Novartis, Merck & Co., Sanofi, and Bayer.

Also, Pfizer, GSK, and AstraZeneca compete in the pulmonary subsector.

Immunology is a subsector split between AstraZeneca, Johnson & Johnson, Pfizer, AbbVie, and Sanofi.

Pfizer, Moderna, Johnson & Johnson, and Merck & Co. mainly cure infectious diseases.

Novartis, AbbVie, Amgen, Johnson & Johnson, and Biogen focus on neurology problems.

The oncology subsector is split between AstraZeneca, Pfizer, Roche, Novartis, Merck & Co., AbbVie, and Bristol-Myers Squibb.

Other rare diseases sub-sectors bring Novartis, Sanofi, and AbbVie to compete.

But the industry is immense.

Companies from the lower tier, with a capitalization between 1 and 30 billion USD, could threaten the larger players in the industry.

There are approximately 40 companies with a valuation somewhere between 10-39 billion and about 150 companies valued under 10 billion dollars.

Latest News about AstraZeneca PLC

The company admitted in court in the wake of this year, 2024, that its jabs can cause ‘in rare cases‘ a disease called TTS.

AstraZeneca PLC faced multiple class actions in January 2024 as a result of the sudden illnesses of people who took the jabs.

In some rare cases, a few people die suddenly, the case of the celebrity BBC anchor – Lisa Shaw.

AstraZeneca faces 255 million pounds in compensation for those who experienced vaccine damages.

Now, AZN has withdrawn the vaccine program, which is good news for investors and public perception.

Given that this is not a usual issue, AZN is also trying to minimize the impact on public perception because of people’s polarization regarding vaccines.

AstraZeneca Stock Overview

Nonetheless, the price has continuously increased despite the news mentioned earlier.

- Analysts have been particularly cautious about this company’s valuation.

- Multiple analysts announced hold or downgrade etiquettes, except Goldman Sachs, Berenberg and Stiffel.

AstraZeneca Chart Analysis

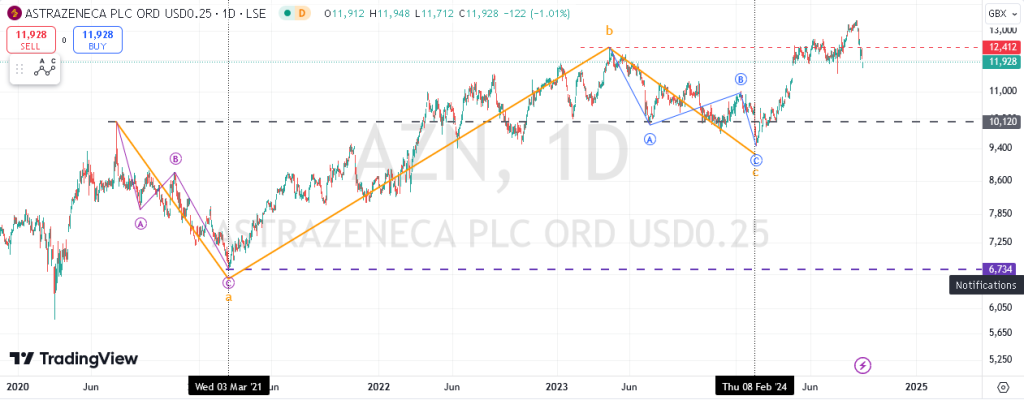

First, I saw the price of developing the c-wave in orange and entering the territory of the a-wave in orange.

So, I had confirmation that the price was developing the a-b-c in orange called Running Flat.

The price would bounce higher again, continuing the move against the Running Flat correction.

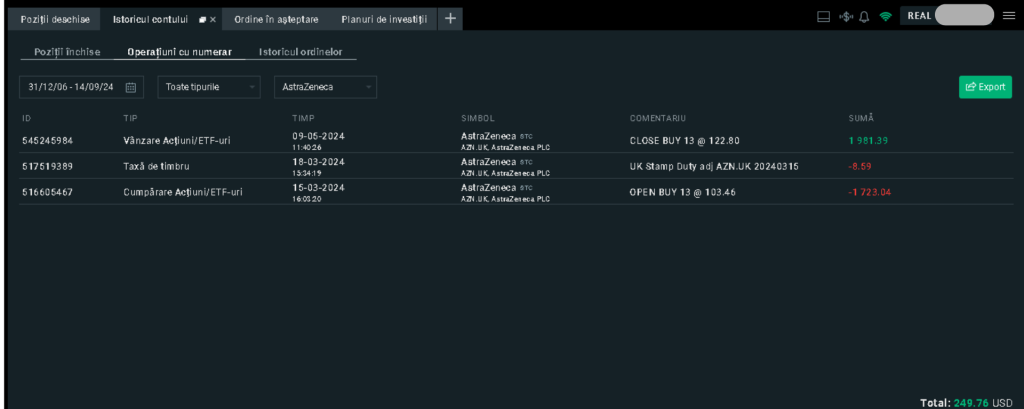

I bought it on 15 March 2024, when the C-wave was finished, as shown in the images below.

This chart analysis is done using the Refined Elliott Wave Theory.

The "Refined Elliott Wave theory" is a pattern-recognition theory. Investors of all kinds leave traces when they make

transactions on the charts.

The traces appear in the form of waves of different amplitudes on the chart.

My Trading Plan

I bought 13 shares and have already cashed in a 15% profit after holding them for one month and a half.

I sold the shares when the stock hit the minimum required price of the structure.

I’ve closed the 122.80, and now the price is 132.2, so why haven’t I kept it?

I left over an additional 7% on the table. But it doesn’t matter.

So, I am going to explain the two big reasons I close it

Once the price touched that top, it could reverse immediately.

Even a minor correction or a significant reversal could have eaten the profit instantly.

Just look at what it did in the last weeks: AstraZeneca shares fell about 12% in 10 days.

Depending on the particular situation, sometimes it is better to cash in the profit.

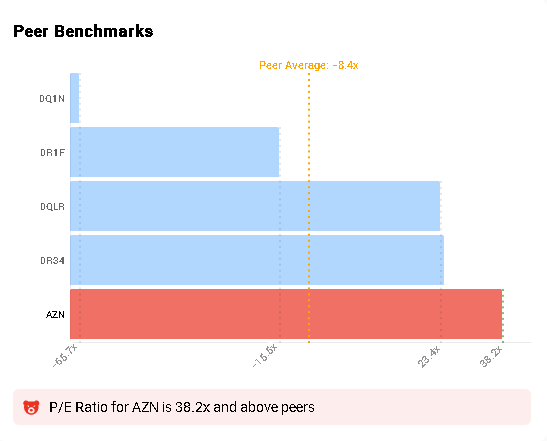

But AstraZeneca stock had multiple years of highs year after year, so it became expensive.

Since 2008, it has made an astounding upside of nearly 1400%.

The valuation is also high compared to the industry, with a PER of over 38.

But I waited and weighed a bit about whether I would keep it.

The second main reason I closed it was the company’s debt of 85.2% and profit margin of 82.6%.

These two metrics ratios may be excellent, but adding cash/total capital was only 2.3%.

So, considering these financial indicators and turbulent financial times, which are not very far off, I’ve closed it without hesitation.

Like a tech company, a healthcare company must continuously innovate to develop evermore efficient drugs.

So, cashing a 15% move was outstanding, given that I made it in less than two months of holding it.

However, I was eyeing other investment opportunities.

Is it worth keeping AstraZeneca in the future?

I am inclined not to do it for now.

If I foresee other plagues or calamities (like a war or a natural disaster) on the horizon, I already have a few names in mind, but not necessarily AstraZeneca. A pharmaceutical company would profit from a prolonged massive war.

Curing wounds would necessitate antiseptics and blood-clothing agents in case of severe injuries, and anesthetics would be the most used.

Competition perspective

But, later on, analyzing what strife competition is in biopharmaceuticals—it’s terrifying.

Besides the big colossal companies from the upper tier, there are over 140 companies with between 1-30 billion capitalization and about 40 companies below 1 billion capitalization.

All these companies, even if it is a small one, can produce a new, cheapest way to create a drug or a revolutionary drug.

It happened before.

For example, Regeneron has produced monoclonal antibodies, and other small companies have produced fantastic breakthroughs. Regeneron increased its capitalization by 10-fold after the discovery in 2011 approval of the drug.

Of course, innovations like this don’t happen very often—maybe once every ten years—but they are not limited solely to companies’ capitalization. So, there is high pressure to innovate and not get behind.

As an aside, unlike most of you, I don’t make judgments based solely on fundamental analysis.

I came from a more technical analysis background, so I had to combine all fundamental data with The Refined Elliott Wave interpretation to get a broader image of how things would develop.

If you enjoyed this article, you might also like: Timing The Next Financial Crash Of 2024 – part 1

News sources:

- AstraZeneca faces up to £255million compensation bill for ‘defective’ Covid vaccine…

- Berenberg maintains AstraZeneca at ‘Buy’

Disclaimer

This article isn’t trading advice, and any financial loss associated with it is solely your responsibility.

However, a more cautious investment approach can generate stability and profit in the long run.

Refined Elliott Wave patterns are hard to identify, and there is always room for error, and I don’t recommend using them. Always seek professional financial advice when investing.

Morraevo doesn’t take responsibility for the sources of its news, even if the sources are mainstream media and investing facts generated by respectable financial sources. Thank you!