I will analyze the Romanian stock Teraplast Bistrița (BVB:TRP) to make a case for selling part of my investment portfolio.

This time, there will be no blurred amounts; it will be total transparency, black and white because there are so many fakes on the Internet and shady stuff: fake investors in the market and all kinds of other schemes, so if possible, I can inspire and encourage you in your efforts to sometimes sell in more unorthodox ways, if you want, when maybe a stock recovers after a substantial decline, as is the case with this stock owned by me, remember that this type of content is unique in Romania and summarizes my work and accumulated experience over 16 years in the capital markets.

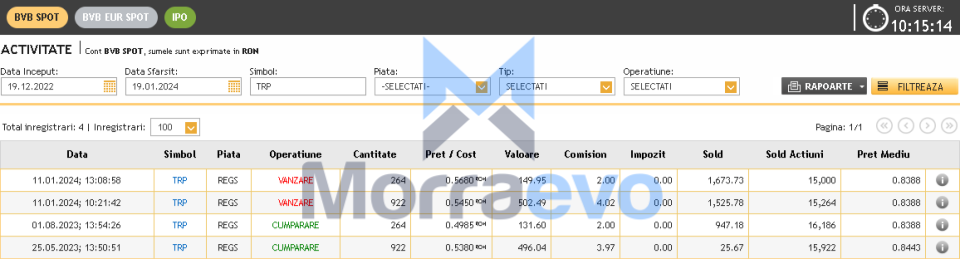

I had 1186 shares bought in two tranches: at the level of 0.4985, I purchased 264 shares, and at the level of 0.538, I bought a tranche of 922 shares, so that at the level of 0.545, I sold 922 shares, and at the level of 0.568 I sold more 264 shares but remained invested in this stock. Why did I do it like that?

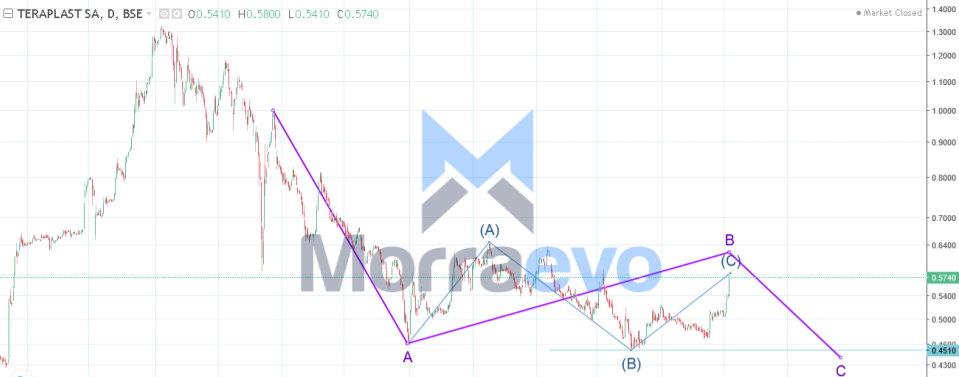

Chart Analysis on Teraplast

Well, let’s see what technical analysis tells us from the point of view of the “refined Elliott waves” theory. The move started at the 0.451 level, representing a wave C of a Flat – (A)(B)(C), colored in blue.

This wave is integral to wave B, part of the higher-order structure ABC. Without going into more details, we will only focus on what the price will do in the short and medium term; the price has reached the minimum level for the ABC structure in blue to be a Running Flat, which is why I exited this action, anticipating a decline below the 0.451 level in the next five months.

If you want to support this project, I would highly appreciate it. You have multiple ways to do it, including via the support page. Thank you!

If you have enjoyed this you might also like this article about Romanian energy sector stocks.

Disclaimer:

This material does not represent trading advice, and any losses associated with this material are strictly your responsibility.